What a terrible first half of the year in the stock market. The S&P 500 closed out the first six months of the year down nearly 21%—the steepest first-half loss seen in more than 50 years. Some of the contributing factors include skyrocketing inflation, supply chain issues, the Federal Reserve increasing interest rates and the Ukraine war. While many investors are wondering what to do, the old adage remains, “buy low, sell high,” this is an opportunity to be buying!

Meanwhile, the supposedly stable fixed income portion of one’s portfolio didn’t fare much better. The bond index (Barclay’s Agg) saw its worst start to a year in history, falling 11% through June. Add in the negative cash returns (interest on your cash minus inflation) and you have the Triple Bear effect! Down stock market, down bond market and negative cash returns.

One strategy many use without even knowing it is called dollar cost averaging. Anyone who defers part of their paycheck in their company’s retirement plan is buying on a consistent basis, thus when the market goes down, you're buying more shares. And when the market goes back up, you actually own more shares and come out ahead.

The absolute worst thing you can do right now is to sell. Some strategies to consider why the market is down include:

1) Tax loss harvesting – Sell some stocks or mutual funds that are down, capture those losses to offset any capital gains.

2) *Rebalance your portfolio – sell some of the funds that are “up” and buy those that are “down”.

3) Invest some cash you have sitting on the sideline, and most importantly,

4) Stay invested!

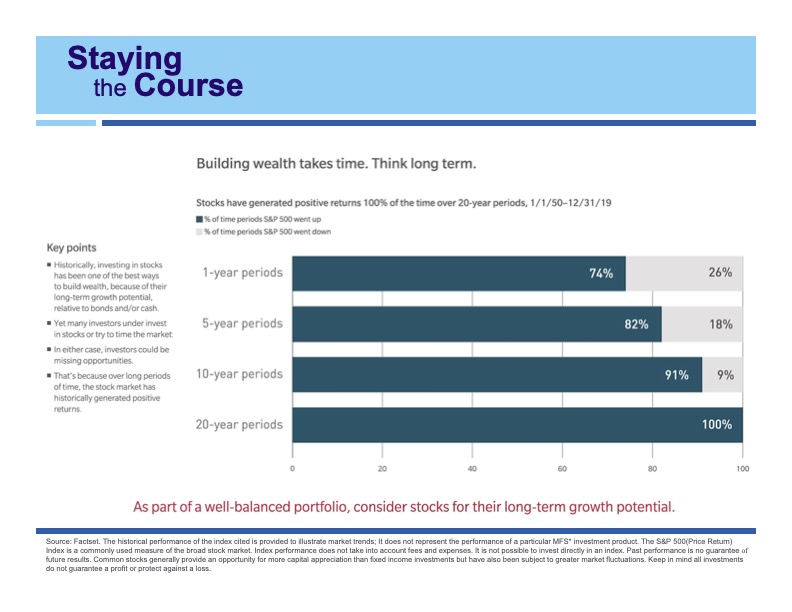

A bull market is around the corner, we just don’t know when. The average bull market lasts five times longer than the average bear market and it’s important to stay invested to catch the rebound. History repeats itself and history teaches us that the market has always gone up in the long run.

The graph below shows over the past 70 years what percentage of the time stocks have had positive returns. You will see that over any 20 year time period, stocks have been positive 100% of the time.

While a sharp recession could certainly bring new lows… already lower stock prices and solid earnings have brought equity valuations below their 25-year average and as of this writing the market has started its rebound!

Warren Buffett once said that it is wise for investors to be “fearful when others are greedy, and greedy when others are fearful.” Right now most people are fearful…

* Rebalancing assets can have tax consequences. If you sell assets in a taxable account you may have to pay tax on any gain resulting from the sale. Please consult your tax advisor.

0Comments

Add CommentPlease login to leave a comment